Lousy phone connections and poor data reception were once a necessary evil for office building occupants. But with more office tenants than ever completing their work with wireless devices, tech-forward building operators are finally addressing their tenants’ wireless infrastructure struggles.

Meanwhile, those who choose not to update their wireless infrastructure risk falling behind in a competitive office market and having their properties lose a Class-A distinction.

“Imagine that you’re standing by the window in a conference room, struggling to get two or three bars of cell service in order to conduct that important call,” Airwavz Solutions adviser and career commercial real estate professional Stuart Hicks said. “Perhaps you’re showing a new space and attempting to use a new custom app that your company built so you can better inform your client, but the data connection is flagging — and you have to give up.”

Dissatisfaction with wireless connectivity is widespread among building tenants. A WiredScore study found that 80% of businesses experience connectivity issues, while 87% of leasing decision-makers list connectivity as a crucial factor in selecting a work environment. Many employees who experience poor connectivity at work are also frustrated at the building and unproductive. To preserve their employees’ mental health and their own bottom lines, corporate tenants may choose not to lease or renew in buildings that fail to address poor wireless capability.

“Wireless carriers cannot take full responsibility and provide all the capital necessary to provide flawless wireless coverage indoors in every single building,” Hicks said. “Building owners must take it upon themselves to partner with wireless carriers or accept that progressive tenants may seek a building with better service when their lease expires.”

In-building wireless capability is quickly becoming an indicator of tech-forward buildings, and tenant rep brokers and tenants are noticing. Soon, Class-A space may include in-building wireless as a prerequisite. Connectivity is second only to location in terms of what leasing decision-makers look for in a new building, and ranks above price, WiredScore reports.

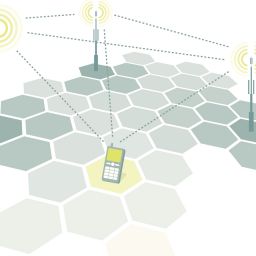

According to Hicks, more requests for information and requests for proposals are including inquiries about in-building wireless systems. Building owners can show prospective lessees their commitment to wireless infrastructure in many ways: the results of a recent Radio Frequency study measuring cellular signal inside the building; data about the performance of carriers like Verizon, AT&T and T-Mobile within offices; or evidence of an in-building Distributed Antenna System that boosts a signal.

And there is no hiding a lack of infrastructure — Hicks says most requests for proposals now ask building owners to acknowledge when they have not made any improvements to in-building cellular networks.

When a building has robust cellular reception — for phone calls, internet searches, texting and streaming — tenants have more productive employees, and brokers have more satisfied clients.

Reducing vacancy will boost cash flow and building values; building owners are recognizing the value of wireless capability when competing for new tenants and retaining existing ones.

A solution from a wireless infrastructure and service provider like Airwavz has low monthly operating expenses, meaning the net benefit for building managers can be hundreds of thousands of dollars in annual occupancy improvement. Once managers implement these solutions, they may begin to see returns in occupancy improvement and retention.

“There is still a bit of first-mover competitive advantage for forward-thinking building owners ready to explore in-building wireless to support occupant needs,” Hicks said. In the near future, Hicks thinks, in-building wireless will have to be a prerequisite, not a bonus.

Contact us today by calling 1-833-AIRWAVZ or filling out our contact form, and we’ll find the right solutions for your business model.